With the issuance of new Companies Regulations, From 29 has now been replaced with Form 9. To report any change in the company management please file Form 9.

SECP Form 29 is one of the forms that are most in-demand due to its nature and purpose. Form 29 with filed with SECP to intimate about any changes in the management of the company.

What is SECP Form 29?

After registering your company and starting your business, often you need to file Form 29 as a statutory requirement. The Securities and Exchange Commission of Pakistan (SECP) under the Companies Act 2017 requires filing Form 29 whenever a change in the management of the company occurs. Through Form 29 you will inform the SECP Company registration office about any change of an officer of your company or any of their particulars. This form is one of the most frequently filed SECP forms.

Section 197 of the Companies Act 2017 requires every company to maintain a register of its officers. The term ‘Officer” includes director, chief executive officer (CEO), company secretary, chief financial officer, auditor, and, legal adviser. To enable the company to maintain that register, the officers are required to provide their particulars to the company as provided in SECP Form 29.

Contents of SECP Form 29

SECP has prescribed certain information to be contained in the register of officers of a company. If you are managing the affairs of your company as an authorized representative you need to collect the following information from your officers:

- Present Name in Full (If the member is a firm then the full name of the firm, its address, particulars of each of the partners, and date of becoming a partner of the firm)

- NIC Number (Passport No. in case of Foreign National)

- Father’s/ Husband’s Name

- Usual residential address

- Designation

- Nationality (If the nationality is not the nationality of origin, also provide the nationality of origin)

- Business Occupation (information on directorship in other companies)

- Date of present appointment or change

- Mode of appointment/change / any other Remarks

- Nature of directorship (nominee/independent/additional/other

You should ensure that the officers of your company provide the above-mentioned particulars to the company within Ten (10) days of their appointment or any change in the particulars.

When to file Form 29 with SECP?

Once you have the required information, you need to file Form 29 within Fifteen (15) days from the appointment or change in appointment of an officer. The changes may occur during the annual general meeting of the company like the election of directors or appointment of auditors. In such a case, Form 29 will be filed along with Form A (annual return). You as an authorized representative of your company will also have to file Form 29 in case of any change in the particulars of the officers.

Please note Form 29 is to be filed within 15 days therefore, you must get the information as soon as possible to avoid delay in filing. If the information is provided by the officer within 10 days, you will have only 5 days to prepare and submit the form.

How to fill out Form 29?

Before you file SECP Form 29, you must understand how to fill the form correctly, to avoid objections. Form 29 has three parts;

- Part 1 contains information about the company and payment details.

- In the 2nd part, you will fill the particulars and information on the appointment or change in the appointment.

- The 3rd and last part will contain your declaration about the correctness of the information and your information as the authorized representative.

Part 2 of the form is the most important, having three sections. You will fill section 2.1in case of a new appointment of an officer. You will mention all the particulars of the officer including the date of his appointment. In column ‘mode of appointment,’ you have to mention either of the following, whichever is appropriate:

- Appointed

- Re-appointment

- Elected

- Re-elected

A common mistake people make is that they do not fill this field appropriately and mention ‘appointed’ even when the directors are elected in the first general meeting or any subsequent election. In case the directors are elected in the first general meeting, the word ‘elected’ should be mentioned. In case of the subsequent election the word ‘re-elected’ should be used. The same is the case with the re-appointment of the CEO, legal auditor, chief financial officer, and legal advisor.

If there is a change in the officers, section 2.2 requires the relevant information of the outgoing officers and the mode in which they ceased to be the officer of the company. An officer may cease to hold the office for the following reasons which needs to be mentioned appropriately:

- Ceased

- Died

- Resigned

- Retired

- Removed

- Disqualified

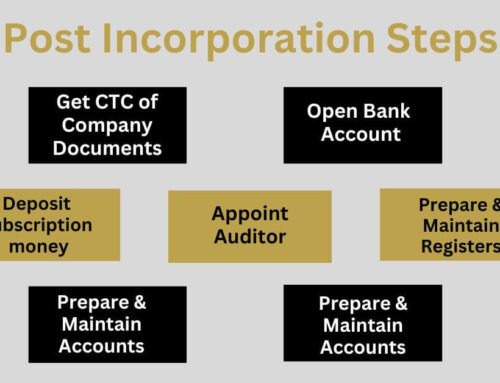

What Documents are required to file Form 29?

As mentioned above, in some instances you will have to file supporting documents with SECP Form 29. For example, if you mention that a director or the CEO has resigned, the law requires you to file the resignation letter, duly signed by him, with the form. Besides, you, being the signatory of the form will have to give an affidavit written on Stamp paper and verified by an oath commissioner. On the other hand, if a director is removed by the member/shareholder, a copy of the members/shareholders’ resolution would be required.

In case of an appointment or election of a new director or appointment of new CEO, you will also file a consent form with the registrar to signify their willingness to act as director or CEO.

Payment of Fee for SECP Form 29

If you have filled out Form 29 correctly, you need to submit it to the concerned company registration office along with the prescribed fee.

Is there any Penalty for Late Filing?

If your company fails to maintain a register of officers and to file Form 29 or delays in filing form 29 with SECP, a penalty will automatically trigger in the form of additional (late) filing fees.

This additional may be up to 5 times the original fee that may be applicable to your company.

In case you fail to comply with the provisions related to filing Form 29, the Registrar may issue a Show-cause notice to you. If you fail to reply to the notice or satisfy the Registrar, he may impose a penalty of Rs. 25,000.

If the default continues, a fine of Rs.500 per day may also be imposed.

Conclusion

Form 29 is required to be filed on every occasion when a change in the management of the company takes place. Hope you have well understood the nature, time of filing and filling, and filing process of SECP Form 29. However, if you have any questions or need clarification, please feel free to contact us or comment below or you may learn about other SECP Forms that you may have to file.

I have submit the form 29 and their challan fee at last Friday but i can not get the form 29 copy not by email or not in our SECP login portal. could you please suggest me the issue

Dear Saqib, First the officer concerned will approve the form. After approval if you have applied CTC, then you will get a copy. Otherwise you will have to apply for CTC.

If a director is appointed to fill a casual vacancy for the remainder of term of retiring director, let’s say three months. Will this three month constitute- / be equivalent to a term (of 3 years as per Companies Act, 2017)?

Dear Shaharyar,

If a director is appointed to fill a casual vacancy, his appointment is against the person in whose place he has been appointed. So the this new directors term will be only for the remaining period of the previous director. His appointment is against the office which has its term starting from the date of election. So this appointed director will retire on the date the previous director would have retired i.e. 3 years from the date of election.

Can you guide me what are the documents that are needed to be filed by a SMC (Pvt) Ltd after incorporation? Also what documents are needed to be filed every year for SMC?

Dear Muaveya, There are no filing requirements for SMC unless there’s a chnage in the company.

My question is we have total 3 directors and 1 Company Secretary all 4 have submitted their resigned and on other hand 2 more new shareholder shown their consent to become a director how can i online file in SECP because authorized person is one of my director and company secretary they all have submit their resignation so please advise

Dear Adeel,

Please note that you will have to submit Form 29 along with the resignations and affidavit of the current CEO about the resignations.

This form will be submitted by the current signatory and when this form is approved, the new directors will designate a new signator for onward submission.

We registered company in 2018 but no form A, 29 was submitted till now. Now we want to transfer shares of one person to the new person, can we do it through FORM A/29 of 2018???

Dear Umair,

Please note that if your company was registered in 2018, your first AGM was due within 16 months from the date of registration. In that meeting election of directors was to be held.

Now if you want someone to oust and replace him with a new shareholder, you can do it by filing Form A for that year along with Form 29 & 28. The new person will be also elected as a director if there are only 2 members and directors. This, however, will be a late filing and will attract an additional filing fee.

SALAM, company registered hoi hai november 2020 mein to to AGM 16 month ki date financial statement date 2021 ki kia honi chahiye agar aaj ki date mein SECP py form A or 29 submit karty hain to

Dear Esmat,

As the law requires, the first AGM must be held within 16 months from incorporation. So while filing Forms A and 29 you can fix any date within 16 months. However, a late fee will apply as the forms will be filed with delay.

for opening a company bank account, bank has asked for Form A, II and 29.

Can you guide me from where I can get these documents.

Dear Kamran,

Please note that at the time of incorporation only Form II, certificate of incorporation (CoI), Memorandum and Articles are made available to a company. If your company is recently incorporated, you can only provide these documents.

Form A is filed 30 days after the Annual General Meeting of the company, which for the first time is due within 16 months from the date of incorporation and then every year within 120 days of the end of the financial year (mostly 30 June).

Form 29 on the other hand is filed whenever there is a change in the management of the company.

So if your company is new, you can provide Form II, CoI, Memorandum and Articles for the bank account. If your company is older than one year, then you can file Form A along with Form 29. After approval of the forms, you can get a digital certified copy of these forms to share with your bank.

I had earlier asked a query which was although answered but a point remained for which I am separately inquiring. Kindly confirm in case of resignation of director, whether all the directors (which are 3 in number in my case) resign at the same time? If yes, how will the BoD (which comprises of them) will approve such resignations or fill casual vacancies. Or the correct way would be to first a single director resign and other 2 directors approve and fill casual vacancy (alongwith filing of required forms (such as Form 29 etc)) and then the 2nd director resigns and so on. Your kind guidance is required in this regard.

All the directors can resign at the same time, though it seems awkward. However, it would advisable that one of the resigning directors or the CEO should file form 29.

Casual vacancies are filled with the approval of the BoD, after acceptance of the resignations of the outgoing directors and approving the incoming directors’ appointment. This will be internal documentation of the Company.

What can be done in case of a company (section 42 – non profit) has three directors and all three directors are required to be removed and 3 new directors appointed. If they all resign, how will board approve/accept resignation since the board comprises of them. Can the way forward and compliance requirements in that case be explained

Dear Shahzaib,

Please note that removal directors will require approval of the general meeting of the company. However, in case of resignation, casual vacancies would arise and can be filled accordingly by the BoD. For filing form 29, the authorized signatory will file the form along with the resignations and affidavit of the CEO of the company.

However, any of the actions must be according to the Articles of the company.

We have to 3 question?

In case of unlisted company. It is compulsory require to file form 29 every year if there is not change in in particulars of directors, if require then what should be mentioned in form 29 at the time of filing SECP although directors and chief executive have been elected in election for 3 year Moreover, what should be written in column MODE OF APPOINTMENT (appoint,re-appointment,elected, re-elected. Plz answer.

Dear Rehan, Form 29 is filed only when there’s a change in the management/officers of the company. Changes may occur even during a year and each time there’s a change, you will have to file Form 29. If there’s no change in the management, there’s no requirement to file Form 29. So far as the mode of appointment is concerned, it will depend on the nature of the appointment. If the directors are elected for the first time, you will mention elected and on re-election, after 3 years, you will mention re-elected. The same is the case with the CEO who is appointed or re-appointed.

AOA,

My company was incorporated in April 2021 with 3 shareholder who are directors as well. Now I want to remove 2 other directors and add 1 new director, so in total the company will end up having 2 directors with 1 share each.

My question is what forms do i need to file in the online SECP portal and what is the process of distributing equal shares among the 2 directors when 2 of them have resigned and 1 new added.

Thank you in anticipation.

Dear Haider, Please note as a compliance requirement you were required to hold your first AGM and hold an election of directors within 16 months from the date of incorporation and file your return i.e. form A. To read more follow the link https://alrushdlaw.com/secp-form-a/

If you have not filed the return, you can report the election and changes in shareholding in the return. However, if you have already filed your return, then you can submit the resignations of the outgoing directors and bring in the new director by filling the casual vacancy.

A Company should appoint auditor with in 90 days of incorporation if its paid up capital is 100,000 and file form 29 for auditor or not?

Dear Zain,

The answer is NO.

i have registered new private company in 2019 with Capital of Rs 500000/ and no change till 2022

should i need to file Form A

should i need to file Form 29

do i need auditor

Dear Waqas, Form A is filed by a company to report proceedings and status at the Annual General Meeting (AGM) of the Company. On the other hand Form 29 is filed at the time when any officer or particulars of officers are changed.

If you incorporated your company in 2019, your first AGM was due within 16 months from the date of incorporation. In that meeting, you were supposed to hold an election of directors. If you have not done that, you will have to file Form A, 29 & 28 for 2020.

Thereafter, keeping in view the capital of the company, Form A was not required for 2021 and 2022 and since there is no change Form 29 was also not required.

So far as the appointment of an auditor is concerned, with a paid-up capital of Rs.500,000, you don’t need to appoint an auditor. However, the registrar may ask for filing unaudited accounts for 2020 and 2021.

If the Board approves Appoint of an Alternate Director, are we required to file Forms 28 and 29 or not?

Dear Nasir,

The appointment of an alternate director (otherwise eligible to become a director and a member) is treated as an appointment for all purposes, and the company will have to intimate the registrar about the appointment. Therefore, the company will have to file Form 28 and Form 29.

Sir plz educate – in case of death of a director, Form-29 will be filed within 15 days from the date of death or from the date on which the DRC is received by the company.

Dear Azhar, Please note that a director can only be a natural person so in case of the death of a director he ceases to hold the office. This should be treated as a change to be reported accordingly, as the company is required to report the change in the constitution of BoD within the given time of 15 days. The requirement is regardless of the knowledge of the company about the death; through DRC or otherwise.

If the DRC is received after 15 days of death and the death was not in the knowledge of the company, an explanation letter may be attached to Form 29.

Dear Sir, can you tell me about the Branch office of the Foreign Company, can file form 29 after change of CEO of the main Company i.e situated in South Korea.?

Please note that Form 29 is for locally incorporated companies. Foreign companies on the other hand have their special forms. In your case you will have to file “Fnc. Form III within 30 days from the date of change.

If we delay the election and directors and chief executive retire, when do we have to file form 29?

Dear Nasir, In case the election is delayed, the existing directors shall keep on holding their respective offices. Form 29 will be filed whenever there is a change. For more information you can mail us to [email protected]

Sir my company is incorporated in year 2022 and we have appointed auditor at that time. Now we want to appoint another auditor for the year 2022. What ll be the procedure. What documents ll be filed with form 29. Can i have formats of all those documents

Dear Muazzam, Did your previous auditor resign or you want to remove him? The law deals both the situations differently. To discuss further, you can contact through whatsapp number given on the site.

Ahsan

Do all companies require a legal adviser and auditor? Or is this requirement only for some companies? Can you please advise for what companies appointment of legal adviser and auditor is mandatory?

Dear Sheryar,

Not all companies are required to appoint legal advisor and auditor.

Legal Advisor is required for a company which has paid up capital of more than 7.5 Million.

Auditor is required for a company with capital above 1 Million.

what value of stamp paper will be used for affidavit confirming resignation of director ?

Dear Khalid,

Stamp paper is required as payment of duty on execution of doucments. Each province has its own rate of duty on affidavit. Please check your local stamp vendor for the rate. However, to be on safe side, you can procure stamp paper of Rs.100/

While filing of form 29, inadvertently CNIC of one Director was wrongly feeded in Form 29. Now how I can make correction in form 29 and Form A

Hi Allah Noor,

If you have submitted the form you can cancel it and refile. If it has been approved then again you can refile with an explanation about the mistake.

We have applied for approval of extension for financial period to prepare annual financial accounts through eService. SECP asked us to provide an affidavit in support of our application.

Legally, there’s no requirement for affidavit. However, you can write a general document stating that the contents of the accompanying application are true etc.

Please share specimen for affidavit in terms of regulation 20 of general provision and forms regulations for auditor

Dear Anum,

No affidavit is required under the law for the auditor. Affidavit is required only in the case of resignation by director or CEO.

Hello

Sir Can Someone Send Form 29 of Company in Back date, let suppose two or three years back and when that happened what should be the Date of Appointment and date od EOGM/AGM

Hi Ashar,

Form 29 is filed within 15 days from the date of appointment/change in the managment. If a appointment/change took place in the past but the form 29 was not filed, it can be filed later, mentioning date of appointment/change when it took place. However, due to late filing, additional fee will be applicable and the Registrar may also issue Show-cause notice and impose penalty on late filing.

Hope it’s clear. Please let us know if you need any furhter assistance.

Hello Ahsan Can I Connect With you Whatsapp ?

Hi Ashar,

You can contact on whatsapp through number mentioned on homepage (at the top left).

plz tell me if one of director or consent authority is not available at that time so we can applied form with other authority’s consent???

Hi Sadaf, Can you please elaborate your question so that I can guide you?

sir my company is incorporate from last 5 years and file returns and now our company want to increase Directors , what proceedings we must taken in SECP???

Dear Alam, You can increase the number of directors by resolution of the BoD 35 days before the General Meeting. The number of directors fixed by BoD will be elected in the General meeting.

Can a Minor may be appointed as director to a private limited company?

Dear Yaser, Under the law a minor can not act as director of a company being not capable of entering into a contract.

(a) It appears that Annual returns (Form A/29) for the year 2020, 2021 have not been filed. Form A/29 are totally defective and incomplete.

kindly tell me how to fulfill the requirements for filling form a/29. thanks

Dear Imran,

Thank you very much for contacting AL RUSHD.

Can you please share the following details:

Company Name

Incorporation date

Forms already submitted before 2020 if applicable.

If you want us check the status thoroughly, please share login credentials.

After examination, we will let you know how to proceed.

You can also contact us through Whatsapp at 03175884918

Assalm-o-Alikum Sir,

Myra sawal hy k agr kisi SMC k director/owner ke immediate death ho jay to is sorat my company kaisy run ho ge or directorship/ownership kis tarha change ke ja ay ge.

Dear Faisal,

In case of death of shareholder/director of a SMC, the nominee direcotor acts as the director of the company till the shares are transferred in the name of the legal heirs. In case the legal heirs are more than 1, the company may be converted into a private limited company.

Salaam, If the Directors of the Company resigns before the AGM, can new Director be elected at the same time and on the same form-29???

Dear Rizwan, In case a director resigns, a casual vacancy arises and the BoD may appoint any other person as director fill the vacancy for the remaining time till the time of election. Now if the resigning directors has sold his shares to another person, the new member/shareholder can become a director. The change of outgoing and incoming direcots can be reported in one form.

Hope it’s clear.

I registered my company as private limited. Now I am looking for the account opening but for account opening they are asking about the Form 29. As per my understanding form 29 is required if there is any change in the list of members in the company. Kindly guide me in this regard.

Dear Saad, Have you applied for the certified copies of the incorporation documents? Instead of Form 29, you can share the Form II alongwith the incorporation certificate and memorandumc & articles.

If you have any further queries, please contact through whatsapp.

A director of a Pvt Ltd Co has sold his entire share holding to an outsider with the consent of the surviving director. Shares transfer process is in pipeline. Can the the outgoing director who is also CEO, resign immediately, just sending a notice to the Co. AND Can Form 29, regarding his resignation, be filed without Resolution?

Pls guide.

The process for transfer of shares to an outsider in a private company is governed by section 76 read with Regulation 13 and is mandatory. Share transfer can only take place once the Board approves the transfer. So far as the resignation of the outgoing director from the office of CEO is concerned, that is separate from the transfer of shares and vacating the office of director. The CEO can resign but he will continue to work unless the new CEO is appointed. Therefore, if the new CEO has been appointed, form 29 may be submitted mentioning both the outgoing and incoming CEO. However, the company will have to file form 29 again on the completion of the share transfer process and the appointment of the new director.

Hope you got the answer. Please write us directly through email at [email protected] in case of any further assistance.

Hi, When to file Form 29 if a director has resigned.

Does the resignation requires approval of the remaining board or Company Secretary may file Form 29 and inform the Board in subsequent meeting.

Thanks

Dear Mr. Salman, The management of the company is in the hands of directors (BoD) and not the company secretary. In case of resignation of a director, the resignation will be presented to the BoD and they will decide upon that and fill the casual vacancy within 90 days from the date of vacancy if needed. Therefore, the resignation will be presented to BoD, and upon their resolution on its approval and filling casual vacancy or otherwise, the company secretary (or the authorized person) will file Form 29 along with relevant documents.

When smc is converted to pvt ltd whether re-election shall be made during filling of annual forms or not??

Dear Asad, When you covert the status of your company from SMC to Private Limited, you require to add an additional one or more directors. The appointment shall be treated as an initial appointment. Later, at the end of the financial year or 16 months from the date of incorporation, you will have to hold AGM of the company and in that meeting, you will elect the directors and file Form A and Form 29.

Hope you understand the requirement as laid down by the law.

We incorporated a Private limited Company on 23.04.2018, subscribers to MOA became directors on 23.04.2018. We filed Form -29 for the subsequent years on 28 Oct. for the years 30-06-2018, 30-06-2019, 30-06-2020.

Now, Directors are elected for 3 years. For the year 30-06-2021, what will be the date of election?

What will be date of re-appointment of Chief executive?

Regards,

Waqar Hussain

Dear Waqar,

Every company has to hold AGM within 120 days from the date of closing of its financial year. If your financial year closes on 30th June, then you have to hold AGM latest by 28th October and then file form A within 30 days from the date of AGM. Directors’ election is held in AGM, so on whatever date you hold AGM, the directors shall be deemed to be elected on that date. Once the directors are elected they can appoint a new CO or re-appoint the existing one and that can be on the same date.

Hope this clarifies your query. In case you need any further assistance, you can contact us on our WhatsApp number.

Please Guide that is it compulsory to file form-45 with annual filling of Form A and Form 29

Dear Hammad,

As required under the law, a company has to file Form 45 at any change in UBO and annually along with Form A. So the answer to your question is, yes.

I opened a Pvt. Limited company with my mother in 2010 and filed forms A and 29, till 2013, but then since then my mother has been ill and I have not done anything with the Pvt. Limited company. It does not even have an Ntn issued. I wanted to know, if I wanted to convert this company into SMC-Pvt. Limited company, in 2021, would there be penalties to do this? How much penalty do you think would be? It has always just been me and my mother, not directorship was changed. Is it possible to convert my Pvt. Limited company, that has had no Form A or Form 29 filed since 2013 to SMC-Pvt. Limtied company?

Conversion of a company from Private limited to SMC will be possible subject to the filing of all the overdue returns (as may be applicable). The returns will be filed with an additional/late filing fee (from two to five times the normal fee). This, however, will not absolve the company any director from other liabilities under the law and the concerned registrar may initiate penal action.

For any further clarification, you may contact us through email.

Can you please guide me when I applied for incorporation (PVT LTD), the registrar asked me about (select nature of directorship as Appointed), I didn’t get his query please guide what should I do for that query,

Dear Adeel,

In a private limited company, at least 2 of the Promoters are “appointed” as directors. The appointment will not be as a nominee or independent director. They are “appointed” as a legal requirement. So please select “Appointed” in the third column “Nature of Directorship” and resubmit your application. Hope this will resolve the issue. In case you need any further help, you may contact us through email.

Kindly advice me the sample of affidavit on stamp paper verified by oath commissioner from signed person of form 29.

Dear Faisal, Thank you very much for contacting us. You can use the following format:

AFFIDAVIT

I ___________ son of ____________, being Chief Executive Officer/Director/Company Secretary of ____________ (Pvt.) Limited (the Company) do hereby affirm:

1) That Mr. __________ director of the Company has resigned from the Company with effect from _______.

2) The Board of Directors of the Company has accepted his resignation and the same has been and duly recorded in the company register(s).

3) That the contents of the accompanying Form 29 dated _________ are correct.

The above statement is true and correct to the best of my knowledge and belief and nothing has been concealed.

Deponent

___________________

[Name]

CNIC_____________________

AoA. If there is no change in the particulars of the officers of the company, even then we have to file the form 29? At the time of incorporation of the company, we have provided a list of directors and chief executive officer and we haven’t changed anything. Should we also file form 29 or there is no need to do so?

Dear Aitzaz, Thank you very much for contacting us.

Form 29 is only filed when there is a change in the officers of the company or their particulars. If at the time of AGM, no change occurs in the officers of the company or their particulars, you do not need to file Form 29.

Do I need to file form 29 after new registration of SMC company

Initially, Form 29 is filed along with other incorporation documents to inform about the officer(s) of the company. However, if the company has been incorporated, then it will not be required until there is a change in the management.