Overview

- What is Special Resolution?

- Difference between an Ordinary Resolution and a Special Resolution?

- When is a Special Resolution Required?

- How to Pass a Special Resolution?

- Special Resolution by Circulation

- Format of Special Resolution

- Procedure for Special Resolution

- Filing of Special Resolution with Registrar

- Providing a Copy of the Resolution to Members

What is Special Resolution?

A special resolution in the company law of Pakistan is defined by the Companies Act 2017. It is a resolution of a company that has been passed by a majority of not less than three-fourths (75%) of such members of the company entitled to vote at a general meeting who:

- are present in person or

- represented by proxy or

- vote through postal ballot

A company must serve a notice to all eligible members of the company specifying the intention to propose the resolution as a special resolution.

Difference between an Ordinary Resolution and a Special Resolution?

A special resolution as mentioned above requires a majority of 75% of the members of a company. In contrast, an ordinary resolution is a resolution that is passed by the simple majority of the members of a company.

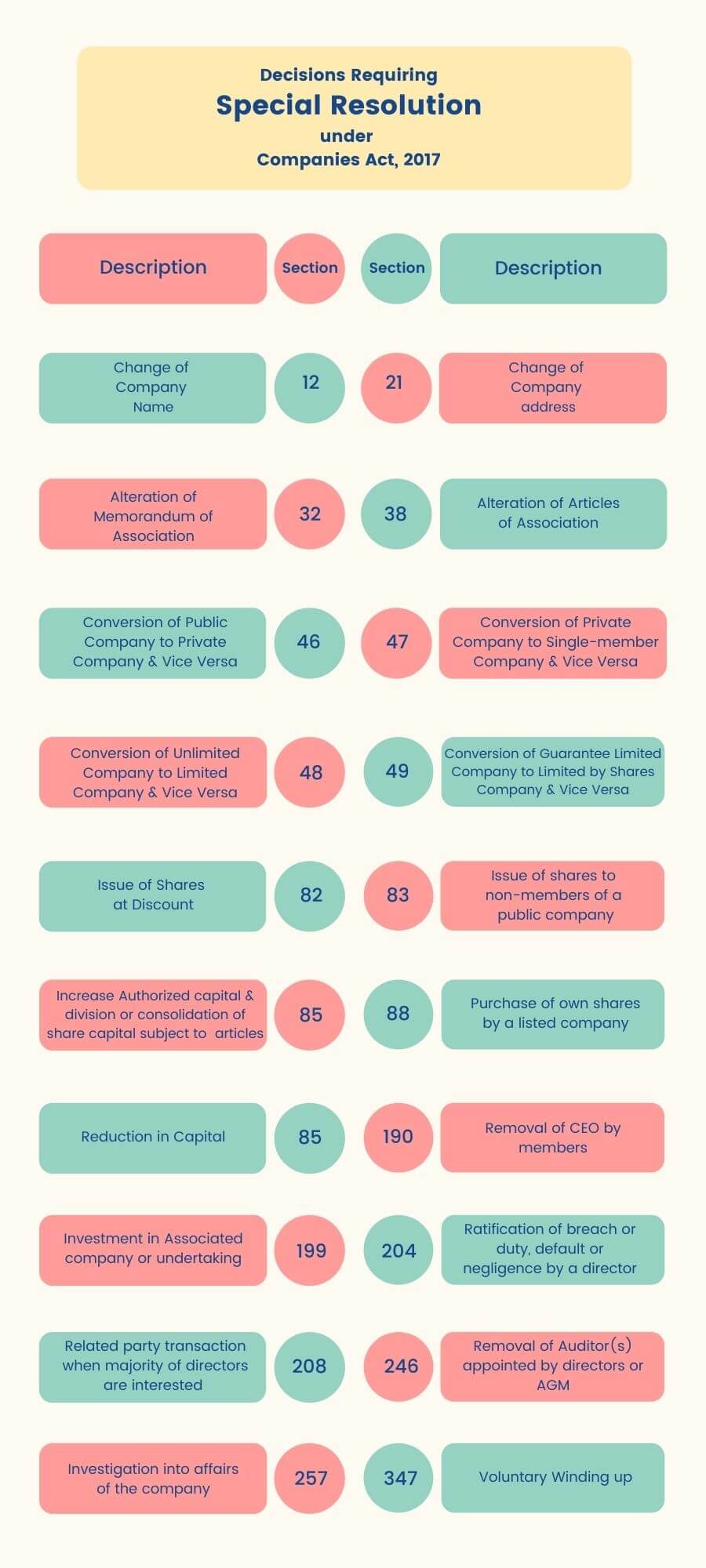

When is a Special Resolution Required?

Not all matters in the company business require a 3/4 majority of the company members. Only a few of the important decisions require the approval of 75% of the members. The matters requiring special resolution are listed below, with the relevant sections of the Companies Act, 2017.

How to Pass a Special Resolution?

Any company can pass a special resolution in the duly convened general meeting of the company. However, private limited companies and public limited companies having not more than 50 members can also pass the resolution through circulation. At least three-fourths of the members, present in person or through a proxy must vote in favor of the resolution. However, when the resolution proposes a change in the rights of shareholders of a particular class, the resolution must be passed by a 75% majority of that particular class of shareholders.

Special Resolution by Circulation

Normally, a special resolution is proposed in a duly convened general meeting of the company. However, a company other than a listed company and a public company with more than 50 members can also pass the resolution through circulation. All the members of the company who are entitled to receive notice of a meeting must be given a copy of the resolution and necessary papers if any. If all the members sign the resolution it shall be treated as valid as a resolution passed in a meeting. It shall not be valid if it has not been circulated to all the members along with the necessary documents.

If a member agrees with the resolution and signs it, he can not revoke his agreement to the resolution. Once a resolution by circulation is passed, it shall be noted in the subsequent general meeting and be made part of the minutes of that meeting.

Format of Special Resolution

The law does not require or prescribe a specific format for the resolution. A resolution for each of the purposes would require a different language. The proposed resolution may be worded in simple language, to show the purpose and intent of the resolution. However, since the resolution is required to be proposed and notified to the members as a special resolution, using the words “special resolution” may be a good idea.

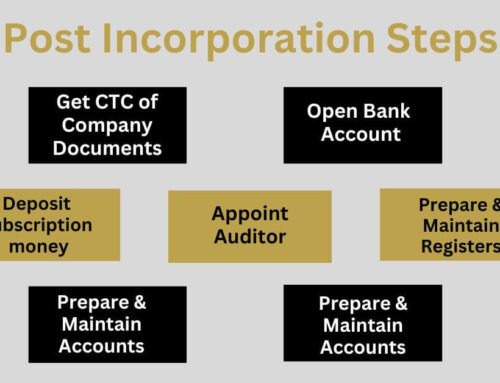

Procedure for Special Resolution

To propose a special resolution for the approval by the members, the company management will have to adopt certain procedures as detailed below.

Resolution by the Board of Directors

First of all the board of directors will pass a board resolution and mention that the resolution requires the approval of three-fourths of the members in the general meeting. The board will then propose convening a general meeting and fixing a date. A special resolution may be proposed in an annual general meeting or the company can call an extraordinary general meeting for that purpose.

Notice of the Resolution to Members

The directors shall send notice of the general meeting to all the members entitled to vote without any exception. The proposed resolution and relevant documents will also be attached to the notice.

Notice Period for the Meeting

Under the Companies Act, 2017 a minimum of 21 days’ notice is required to call a meeting in which a special resolution is placed for the approval by the members. However, if all the members entitled to attend and vote at any meeting agree, a resolution may be proposed and passed as a special resolution at a meeting of which less than twenty-one days’ notice has been given.

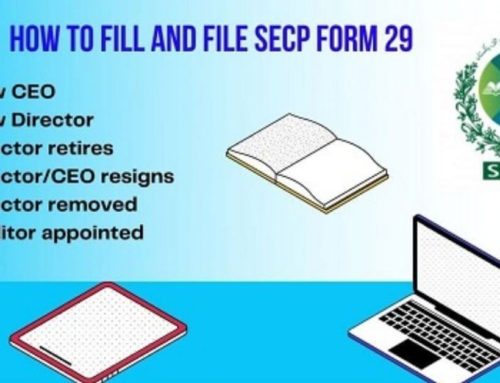

Filing of Special Resolution with Registrar

The law requires all companies to file with the registrar a copy of every special resolution when passed in the prescribed form. For this purpose, Form 26 has been prescribed, with a specified procedure. Failure to file Form 26 may invite penal action by the registrar.

Providing a Copy of the Resolution to Members

When a special resolution is duly passed by the company to alter the articles, the changes shall be embodied in the articles of association or annexed to it. Every copy issued after alteration must include the altered clauses or the special resolution must be attached to the articles. If a member requests a copy of the special resolution, the company is bound to provide the copy to the member on payment of the fee. The company may charge a reasonable fee for providing a copy of the resolution.

Leave A Comment