Overview

Investment in Associated Companies and Undertakings

Investment in associated companies and undertakings is one of the options available to companies for expanding their business and undertaking innovative projects. However, certain situations may arise in which the investment may not be as rewarding as estimated or expected. Further, they may have potentially damaging effects on overall profitability.

Sometimes, interested parties may manipulate the transaction for their own interests, putting the ordinary shareholders to a disadvantage. Therefore, to curb any such attempt and safeguard the interests of shareholders, the law provides certain restrictions and conditions for investment in associated companies and undertakings.

In Pakistan also, the law adequately addresses this matter—section 199 of the Companies Act 2017 (the 2017 Act). Section 199 of the 2017 Act and the Companies (Investment in Associated Companies or Associated Undertakings) Regulations, 2017 (the Regulations) [i] provide the relevant law, procedure, and disclosure requirements.

Definition of Associated Company or Undertaking

Before discussing the details of the procedure, it is imperative to know how associated companies and undertakings are defined. Section 2 (4) of the 2017 Act provides that if two or more companies or undertakings, or a company and an undertaking are interconnected in a particular way, they will be treated as associated companies and undertakings. In terms of the definition, the following scenarios will be treated as a relationship between associated companies and undertakings:

- Companies or undertakings are under common management or control;

- One company or undertaking is a subsidiary of the other;

- Modaraba (undertaking) is managed by the company;

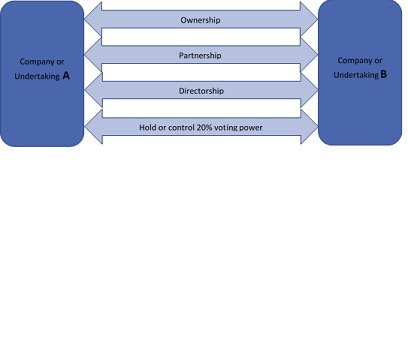

- An owner, partner, director, or another person, directly or indirectly, holding or controlling shares (including shares held or controlled by the spouse or minor children of the person) with at least 20% voting power in a company or undertaking is also owner, partner, director or holding or controlling shares with at least 20% voting power in the other company or undertaking. (This relationship is shown in the figure below):

In addition, section 2 (4) also defines “associated persons” in the same manner as it defines relationship “d)” above- also illustrated in the figure above, but with the limit of 10% voting power. However, this term has not been used anywhere in the 2017 Act or regulations made thereunder.

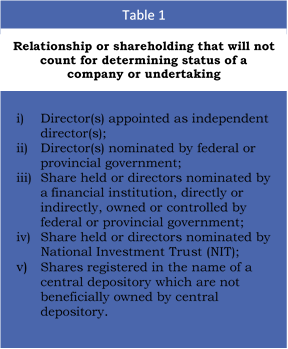

After defining the relationship that determines the status of a company or an undertaking as associated companies and undertakings in clear terms, the law creates some exceptions (see Table 1) where relationships and shareholdings will not be counted for determining the status of a company, undertaking or person as an associated company, undertaking or person.

In order to provide the law and regulate investment in associated companies and undertakings, the 2017 Act specifies the activities that will be considered as investments. These activities include equity, loans, advances, and guarantees, by whatever name called. This means a loan given to associated companies will also be governed under section 199 and the Regulations.

However, if the amount due is normal trade credit, arising out of an arms-length trade transaction, and is in accordance with the trade policy of the company, such transactions shall not be treated as investment for the purpose of application of section 199. It is to be noted that “guarantees” were not treated as an investment in the repealed Companies Ordinance, 1984, and is an addition to the 2017 Act.

Law and Procedure for Investment Decision

Since it is clear how companies or undertakings are treated to be associated and what investment means, now let’s discuss the law on investment in associated companies and undertakings.

Since the ordinary shareholders/members do not have an active role in the day-to-day affairs of the company or undertaking. Therefore, safeguarding their interest requires that their money is not invested in any other company or undertaking with conflicting interests without their knowledge and permission. Any person, partner, or director may have interests in the investment which may affect the interest of the ordinary shareholders.

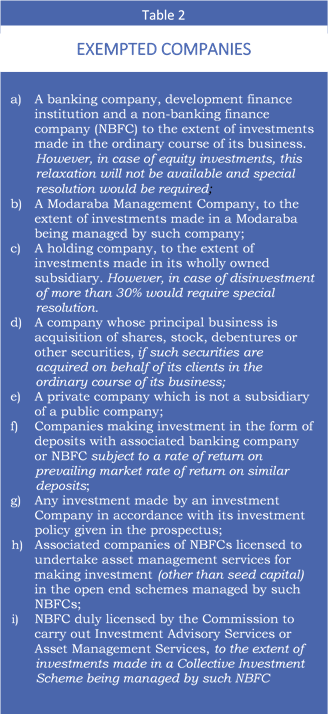

As a general principle, investment in an associated company or undertaking can only be made by a special resolution (75% of the shareholders/members present in person or through a proxy) so that shareholders/members’ money may not be used for the vested interests of anyone. It would not be out of place to mention that a special resolution passed by the company will have to be reported to SECP by filing Form 26 However, certain companies, keeping in view the nature of their business, have been exempted from to fulfill this requirement. The exempted companies[ii] are mentioned in Table 2.

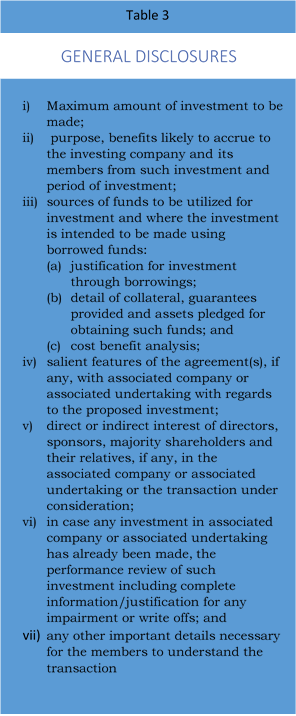

As the law requires that any decision of investment in an associated company or undertaking would, where applicable, be taken by shareholders/members in general meetings, it was imperative to provide a mechanism for sufficient disclosure so that the shareholders/members can make an informed decision. Therefore, regulations have been issued that specify what necessary information should be provided to shareholders/members for seeking their approval, based on a complete picture of the investment proposal.

Disclosure Requirements related to investment in Associated Companies

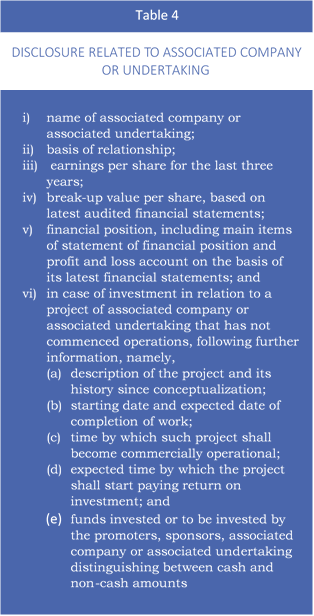

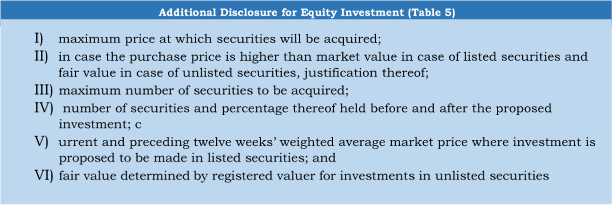

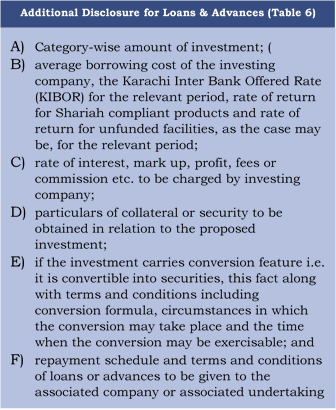

The regulations made in terms of section 199 (3) (b) prescribe the information required to be provided to members which shall be attached with the notice of the meeting called for approval of members. The information shall include, general disclosure (Table 3), disclosure about the associated company or undertaking (Table 4), and disclosure for equity investment (Table 5) or for advances and loans (Table 6) as the case may be.

Further, information about the interest of the associated company or associated undertaking and its sponsors and directors in the investing company shall also be disclosed in the notice of general meeting if the associated company or associated undertaking or any of its sponsors or directors is also a member of the investing company.

Listed companies are required to dispatch a copy of the notice and the statement of material facts to the head office of the Securities and Exchange Commission of Pakistan, through fax or email and courier service on the same day it is dispatched to the members.

The directors of the investing company, while presenting the special resolution for making an investment in an associated company or associated undertaking are required to certify to their members that they have carried out necessary due diligence for the proposed investment before recommending it for members’ approval and that the financial health of the borrowing company is such that it has the ability to repay the loan as per the agreement.

It is pertinent to mention that the law requires that Investment by way of loans or advances can only be made in accordance with an agreement in writing which shall inter-alia include the terms and conditions specifying the nature, purpose, period of the loan, rate of return, fees or commission, repayment schedule for principal and return, penalty clause in case of default or late repayments and security, if any, for the loan in accordance with the approval of the members in the general meeting.

The law further requires that duly signed recommendations of the due diligence report shall be made available to the members for inspection in the general meeting called for approval of the special resolution for investment. The law requires full disclosure of the proposed investment transaction.

Further, the latest annual audited financial statements of the associated company or associated undertaking along with the latest interim financial statements, if any, shall be made available for inspection by the members in the general meeting called for considering investment decisions in the such associated company or associated undertaking.

In order to ensure that the transaction is transparent and the members make an informed decision about the investment, the law requires that if the associated company or associated undertaking or any of its sponsors or directors is also a member of the investing company, the information about the interest of the associated company or associated undertaking and its sponsors and directors in the investing company shall be disclosed in the notice of a general meeting called for seeking members’ approval.

Shareholders/members’ right and role does not end while passing the resolution but it continues until is fully implemented. In case shareholders/members’ decision to make the investment is not fully implemented in line with the approval till the holding of subsequent general meeting, directors shall be liable to explain the status of the decision to the members through a statement having details of total investment approved, amount of investment made to date, reasons for deviations from the approved timeline of investment, where investment decision was to be implemented in the specified time and material change in financial statements of the associated company or associated undertaking since the date of the resolution passed for approval of the investment.

Other Restrictions and Conditions in Investment in Associated Companies

Apart from the disclosure requirements, the law also imposes certain conditions and restrictions on investing companies in respect of the investment. If a company desires to invest in unlisted equity securities of the associated company or undertaking, the fair value of the security shall be valued by a valuer registered under section 460 of the 2017 Act.

The investment, if allowed by the shareholders/members is up to a certain limit, such limit (in whole or on a piecemeal basis) shall stand exhausted on reaching that limit and no reinvestment would be allowed, even if some amount is disinvested.

In the case of equity investment, the investing company shall transfer share deposit money only after the announcement of the offer for the issue of shares by the associated company or associated undertaking, and shares/securities shall be issued within 90 days (this time in an ordinary case is 30 days). In case of failure to issue shares, the share deposit money shall be treated as a loan, which shall be subject to interest, mark up or return from the date of transfer of funds.

To make sure that the investing company is not put into a disadvantageous position, the law requires that the rate of return on loans, advances, and debt securities, etc. shall not be less than the Karachi Inter-Bank Offered Rate (KIBOR) for the relevant period or the borrowing cost of the investing company, whichever is higher. However, the applicable KIBOR rate (daily, weekly, monthly, etc.) has not been specified and is left to the decision-makers. The rate of return for Shariah-compliant securities should not be less than the earnings of Islamic banks or Islamic financial institutions on similar facilities.

Further, on non-fund-based facilities (guarantees, letters of indemnity, etc.), the rate of return must be compatible with commercial or Islamic banks, as the case may be. Income streams (interest, markup, profit, fee, or commission) shall be periodic, in line with the approval of the shareholders/members.

A running finance facility, revolving credit, or any similar facility is not allowed for a period of more than one year. However, the same may be renewed by the shareholders/members upon a new resolution, if required.

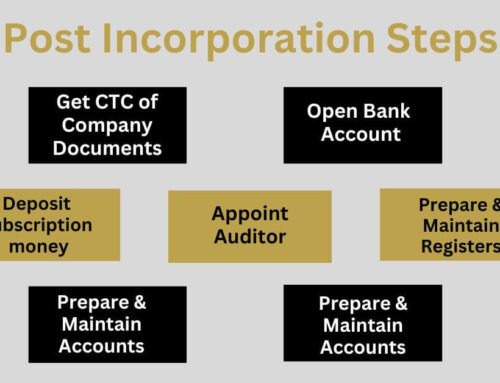

Maintaining Record of Investment in Associated Companies

To maintain transparency, the law provides that investing company shall maintain, at its registered office, a register of investments in associated companies and undertaking in the prescribed format. Such register shall be updated on an instant basis, as and when an entry is required, and entries shall be authenticated by the company secretary or another authorized person. The inspection of the register shall be allowed as per the normal procedure.

Like every law, the law on investment in associated companies and undertakings, through penal provisions, ensures that its provisions are complied with in letter and spirit, therefore contraventions are liable to penal action. In case any provision section 199 is violated, a penalty of level 3 on the standard scale (up to Rs.100 Million) may be imposed. Additionally, if a loss occurs to investing company due to non-compliance with the provisions of section 199, the person liable for such non-compliance shall jointly and severally reimburse the amount. However, if the violation relates to the provision of regulations, the penalty shall be up to Rs.5 Million.

Conclusion

The above discussion shows that the law, though allows investment in associated companies, however, the same can only be made with the approval of the shareholders/members, and complete disclosure to shareholders/members would be required before the transaction to allow them to make an informed decision. Further, proper records should be maintained about all investments made in associated companies and undertakings.

If the law is implemented in letter and spirit and monitored thoroughly by the shareholders/members and regulator, it will bring transparency and help in building more confidence in the regulatory regime of the companies.

Hope you now understand how you can make an investment in associated companies and undertakings. However, if you have any queries, please leave a comment or Contact Us.

Leave A Comment